27 May Governance Upgrade: Professional Boards

By: Mike Schmitt, The Rubra Group, LLC

In the latest 2023 Global Family Business Report by KPMG and the STEP Project Global Consortium, one key finding stands out: family businesses that adopt formal governance structures with at least 25 percent independent board members consistently outperform their peers in longevity, innovation, and financial performance. This marks a definitive shift in best practices. Independent directors are no longer a “nice to have”—they are now a strategic imperative.

Independent board members offer objectivity, strategic insight, and accountability mechanisms that internal, family-only boards often struggle to maintain. Their inclusion facilitates more robust decision-making and reduces the emotional bias that can plague family discussions. This can be particularly crucial during succession transitions, strategic pivots, or capital raises.

Building a Purpose-Driven Board

Creating a professional board begins with intentional design. An effective board composition blends deep family insights with non-family expertise. This often includes:

- Family directors who represent the legacy and continuity of the enterprise.

- Non-family executives who understand the company’s operations.

- Independent directors who bring specialized skills, challenge groupthink, and support governance.

The KPMG/STEP report shows that boards with at least one-quarter independent directors not only deliver higher shareholder value but are significantly more resilient in times of crisis.

These boards are more likely to engage in proactive succession planning, maintain investor confidence, and balance emotional and financial considerations during critical decisions. Importantly, they also tend to support next-generation leaders with coaching and mentorship, encouraging innovation while preserving foundational values.

Clarifying Roles and Decision Rights

As boards become more diverse, role clarity becomes essential. The board’s mandate should be centered on strategic oversight, risk governance, CEO accountability, and succession planning—not day-to-day operations. Separating the roles of board chair and CEO is also recommended to avoid conflicts of interest.

Successful family businesses establish charters for their boards and their family councils. These documents codify decision-making rights, expectations of directors, term limits, and protocols for handling disputes or underperformance. They create a structured yet flexible framework that allows the business to scale while preserving its cultural DNA.

Term Limits and Performance Reviews

Just like any high-functioning team, board members must be evaluated. Annual self-assessments and peer reviews are becoming best practice in leading family firms. These tools promote accountability and provide an opportunity to refresh board composition in response to evolving strategic needs.

Many firms now include term limits for independent directors, staggered so that institutional knowledge is preserved while new thinking is continuously introduced. This cadence helps the board remain dynamic and closely aligned with the company’s growth trajectory.

Education and Integration

Independent directors must be oriented to the family’s values and vision. Onboarding should include the family history, legacy objectives, and introductions to key stakeholders—not just financials and operations. When done well, this integration helps independent board members act as stewards of both performance and purpose.

At the same time, ongoing director education ensures that the board remains current on governance trends, regulatory developments, and industry shifts. Providing board members with access to relevant learning resources or family business seminars can sharpen their contribution.

A Case for Governance as Strategy

Boards that are built intentionally with diverse expertise and structured protocols become more than supervisory bodies—they become catalysts for generational continuity. According to the KPMG/STEP study, family businesses with professional boards are far more likely to remain in family hands across three or more generations.

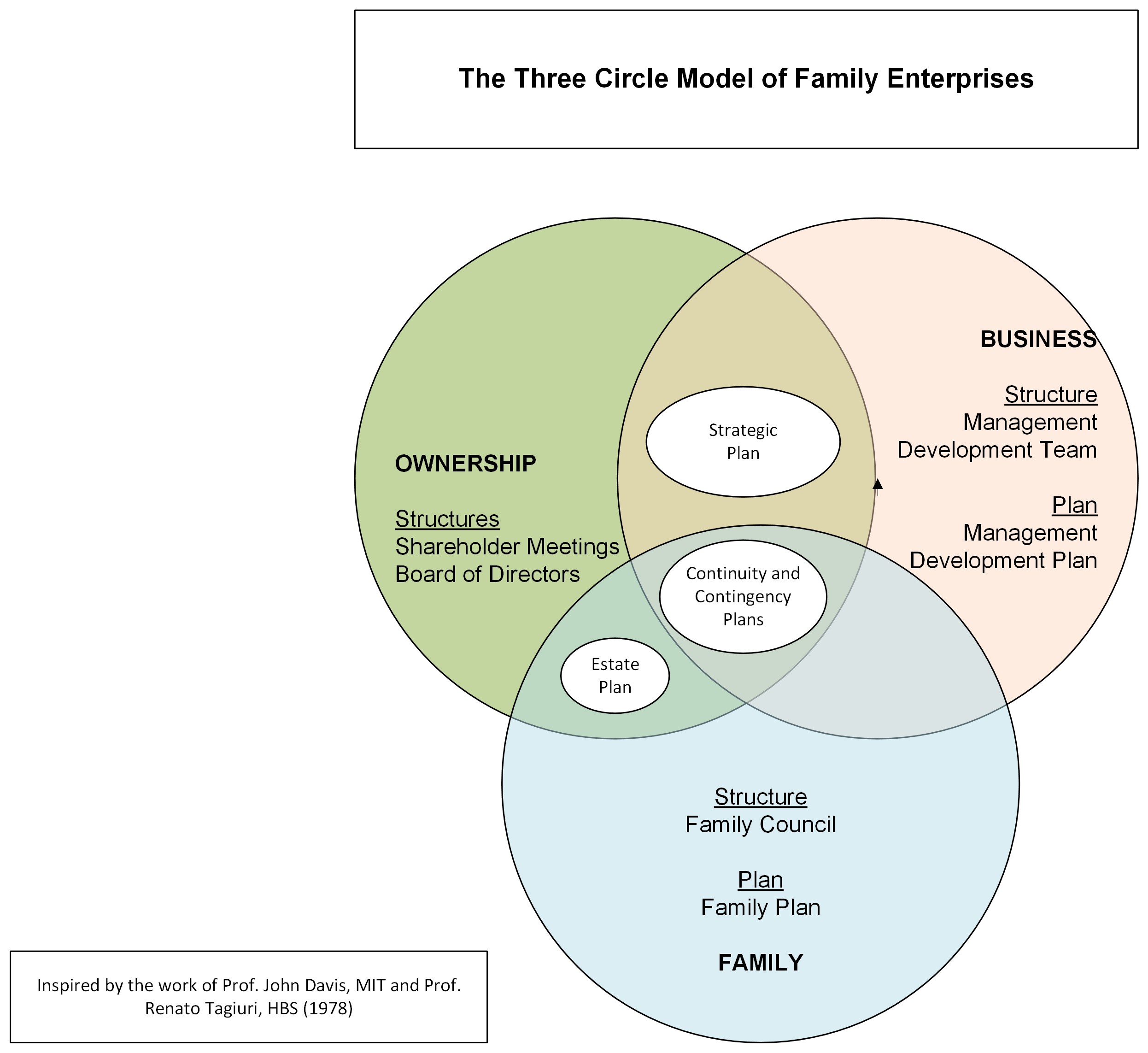

That kind of longevity requires more than operational success. It demands disciplined governance, shared values, and clear communication between ownership, board, and management. A professional board does not dilute family influence; it enhances it by surrounding the family with insights that challenge, sharpen, and strengthen their leadership.

No Comments